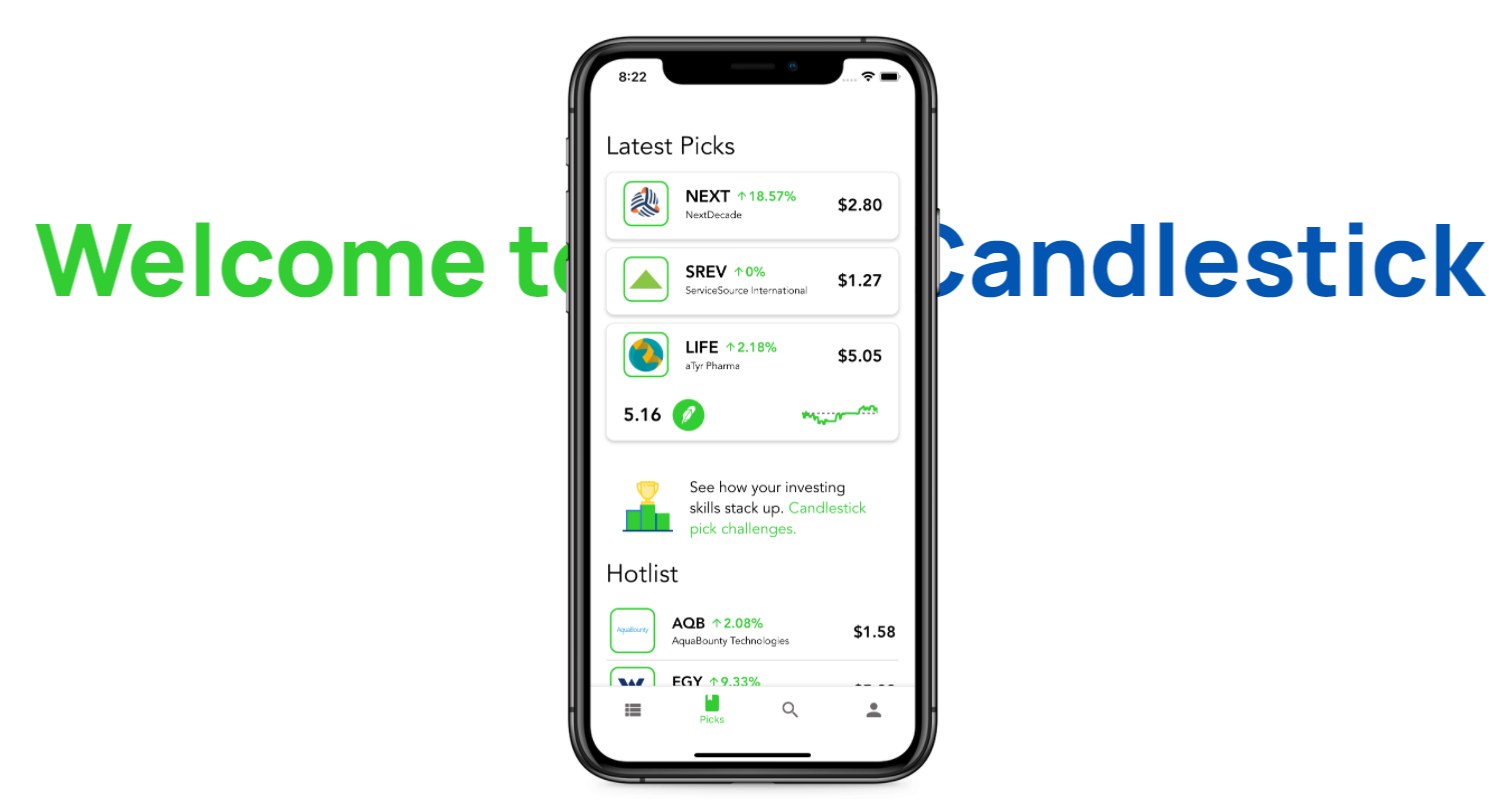

Introduction

What is a Candlestick?

Candlestick charts are a visual way to understand price movements of assets like stocks, currencies, or cryptocurrencies. Instead of just showing the high, low, open, and close prices as a simple line graph might, a Candlestick displays all four in a single, easy-to-interpret shape. This makes it much simpler to quickly grasp the overall market sentiment and potential trends.

Understanding the Candlestick Shape

Each Candlestick represents a specific time period, like a day, an hour, or even a minute. The body of the Candlestick shows the range between the opening and closing prices.

* **Bullish Candlestick (Green or White):** If the closing price is higher than the opening price, the Candlestick is usually shown in green or white. This indicates a positive market sentiment—buyers were more active during that period. The longer the body, the stronger the buying pressure.

* **Bearish Candlestick (Red or Black):** A red or black Candlestick signifies a closing price lower than the opening price. This means sellers dominated during the period, indicating negative market sentiment. Again, a longer body suggests stronger selling pressure.

* **The Wicks (Shadows):** The thin lines extending above and below the body are called wicks or shadows. The upper wick shows the highest price reached during the period, while the lower wick shows the lowest price. Long wicks can indicate indecision in the market, while short wicks might suggest strong conviction in the direction of the price movement.

Why Use Candlestick Charts?

Candlestick charts offer several advantages over simpler price charts:

* **Visual Clarity:** They provide a quick and easy overview of price action, making it simpler to identify trends and patterns.

* **Pattern Recognition:** Many Candlestick patterns have been identified and associated with specific market behaviors. Learning these patterns can enhance your trading or investment strategies.

* **Market Sentiment Analysis:** The color and size of the Candlesticks readily reveal the prevailing market sentiment (bullish or bearish) during a given period.

Common Candlestick Patterns (A Quick Overview)

Numerous Candlestick patterns exist, each with its own interpretation. Some popular ones include:

* **Doji:** A Candlestick with a very small or no body, indicating indecision in the market.

* **Hammer:** A bullish reversal pattern characterized by a small body and a long lower wick.

* **Hanging Man:** A bearish reversal pattern similar to a hammer, but it forms at the top of an uptrend.

* **Engulfing Pattern:** A two-Candlestick pattern where the second Candlestick completely engulfs the first, signifying a potential trend reversal.

Getting Started with Candlestick Charts

To effectively use Candlestick charts, you need access to a charting platform provided by your broker or a financial data provider. Many free and paid options are available online. Remember, while Candlestick charts are a valuable tool, they should be used in conjunction with other forms of technical and fundamental analysis for informed decision-making. Never rely solely on Candlestick patterns for investment decisions.

**Disclaimer:** This content is for educational purposes only and should not be considered financial advice. Investing in any market involves risks, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

This content aims to provide a user-friendly introduction to Candlestick charts, offering sufficient information for a blog post, project document, or product introduction. The use of headings, bullet points, and a clear structure enhances readability and SEO optimization. The disclaimer reinforces credibility and responsible information sharing.