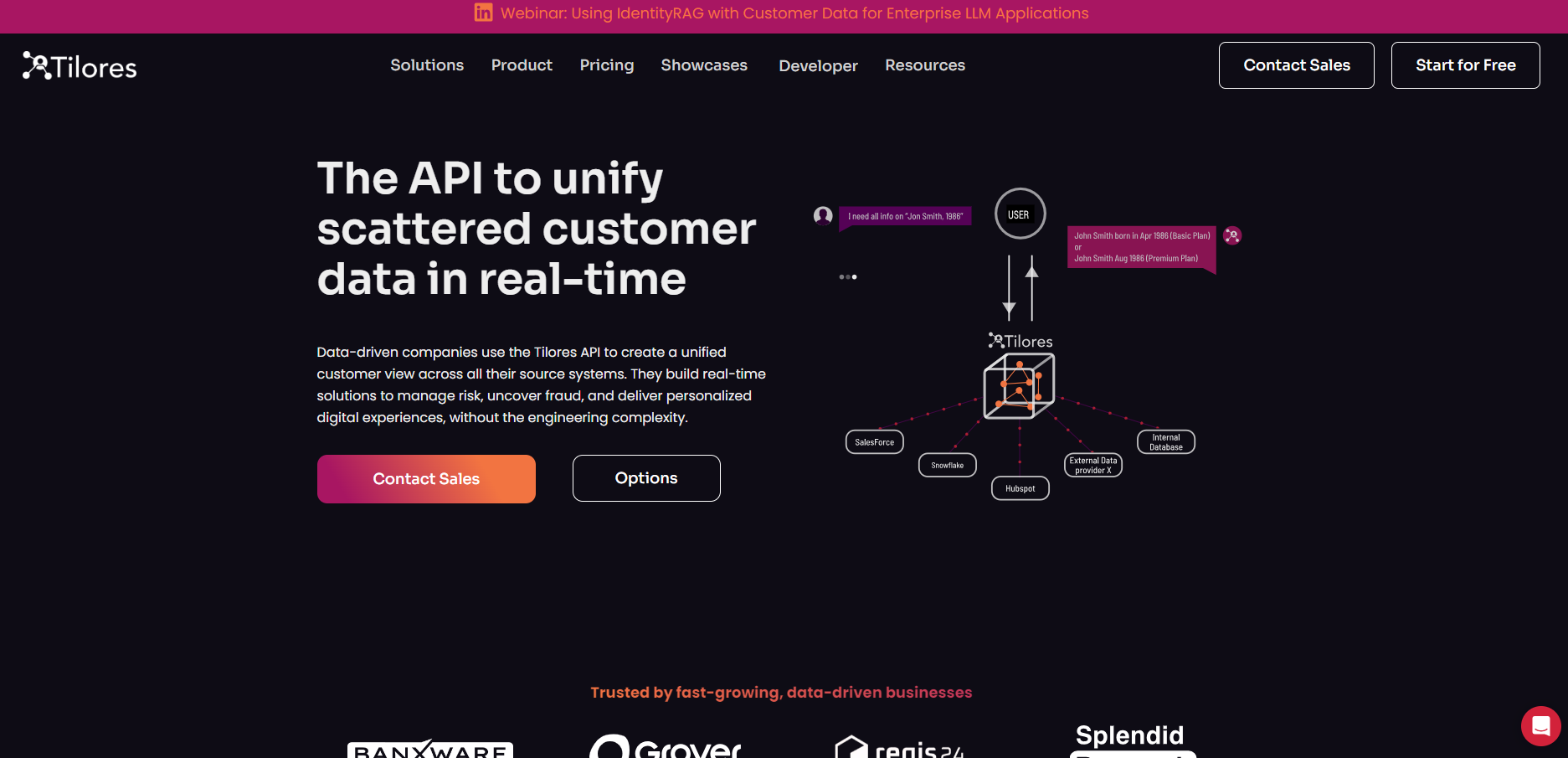

What is Tilores?

Tilores is a cutting-edge technology company that specializes in entity resolution, originally developed for consumer credit bureau use in eCommerce risk and fraud prevention. Founded by Stefan Berkner, Hendrik Nehnes, and Steven Renwick in Berlin, the company offers a serverless, graph-like technology that transforms how organizations handle disparate and inconsistent datasets. The platform serves as a comprehensive solution for data scientists and data-driven companies who need to manage, clean, and unify customer data efficiently without compromising on scalability or speed.

Key Features of Tilores

Tilores is a highly-scalable entity resolution platform that helps companies unify and manage scattered customer data across multiple source systems in real-time. It offers automated data cleaning, matching, and deduplication capabilities while maintaining data privacy compliance. The platform provides a no-code interface and API integration options, allowing businesses to create unified customer views, prevent fraud, and power AI applications without complex engineering requirements.

Real-time Data Unification: Performs live searches, linking and normalization of data as it arrives from different source systems, creating a unified customer view

Privacy-Compliant Architecture: Built with data privacy at its core, ensuring compliance with data protection regulations while handling sensitive customer information

Automated Data Management: Offers automated data cleaning, matching, and deduplication capabilities with clear reasoning for each profile merge or relationship mapped

Flexible Integration Options: Provides GraphQL API and pre-built connectors for various platforms like Salesforce, Hubspot, and Snowflake

Use Cases of Tilores

Customer 360° View: Enables businesses to create complete customer profiles by combining data from multiple sources, improving customer service and internal alignment

Risk & Fraud Management: Helps detect fraud at account creation by matching new sign-ups with existing customer data and uncovering relationships between account holders

LLM Enhancement: Improves LLM performance through real-time fuzzy search on structured data, enabling more accurate and contextual responses

Regulatory Compliance: Supports KYC & AML compliance requirements by maintaining accurate and unified customer records