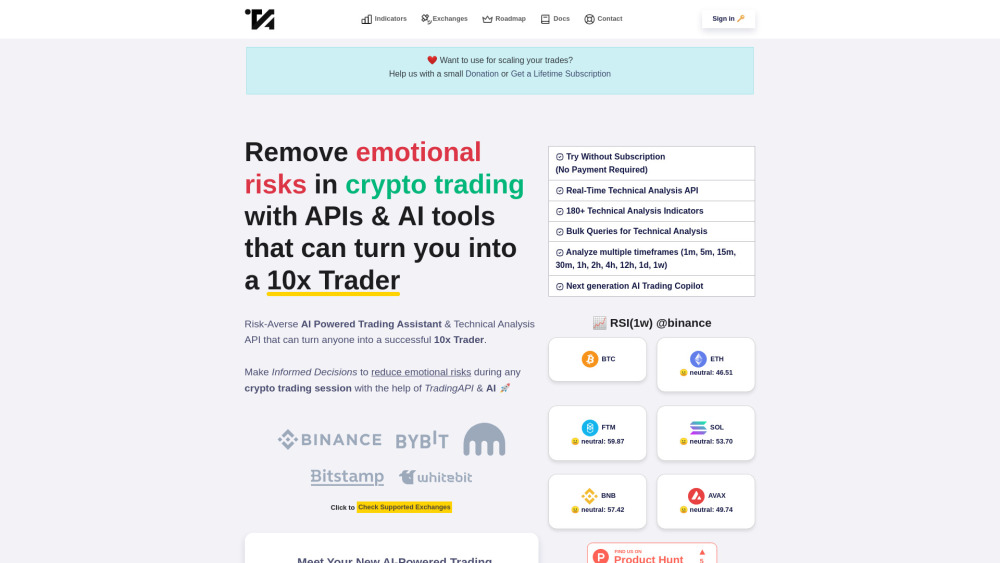

What is TradingAPI.rest?

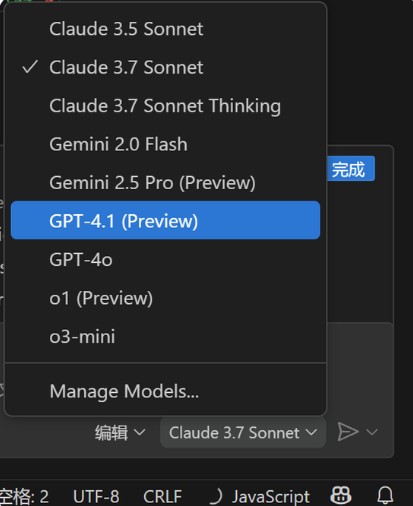

TradingAPI.rest is a web-based trading platform aimed at simplifying and enhancing cryptocurrency trading through advanced technical analysis and artificial intelligence. It acts as a central hub combining technical analysis tools, real-time market data from over 33 crypto exchanges, and an AI-powered trading assistant. This platform caters to both algorithmic traders and regular traders looking to make more informed, emotion-free trading decisions.

Key Features of TradingAPI.rest

TradingAPI.rest is a comprehensive trading platform that integrates technical analysis API capabilities with AI-powered trading assistance. It analyzes real-time market data across multiple exchanges, offers more than 180 technical indicators, supports bulk queries, and uses natural language processing to explain market data without technical jargon. The platform covers various timeframes and markets including cryptocurrencies, stocks, forex, and DeFi, while aiming to reduce emotional trading risks through AI-driven insights.

AI-Powered Trading Assistant: Provides real-time market analysis and trading recommendations in simple language, helping traders make informed decisions.

Comprehensive Technical Analysis API: Offers over 180 technical indicators with support for multiple timeframes and bulk queries across different exchanges.

Multi-Exchange Integration: Connects with over 33 crypto exchanges including both centralized (CEX) and decentralized (DEX) platforms, providing unified access to diverse market data.

Real-Time Data Processing: Delivers instant market analysis and updates across multiple assets and exchanges, enabling timely trading decisions.

Use Cases of TradingAPI.rest

Algorithmic Trading: Developers can integrate the API to build automated trading systems with access to comprehensive technical analysis and market data.

Portfolio Management: Traders can track and analyze multiple assets across different exchanges from a centralized dashboard.

Telegram Group Trading: Integration with Telegram groups to provide real-time market analysis and trading signals to community members.

Risk Management: Institutions can use the AI-powered analysis to assess market risks and make data-driven trading decisions.