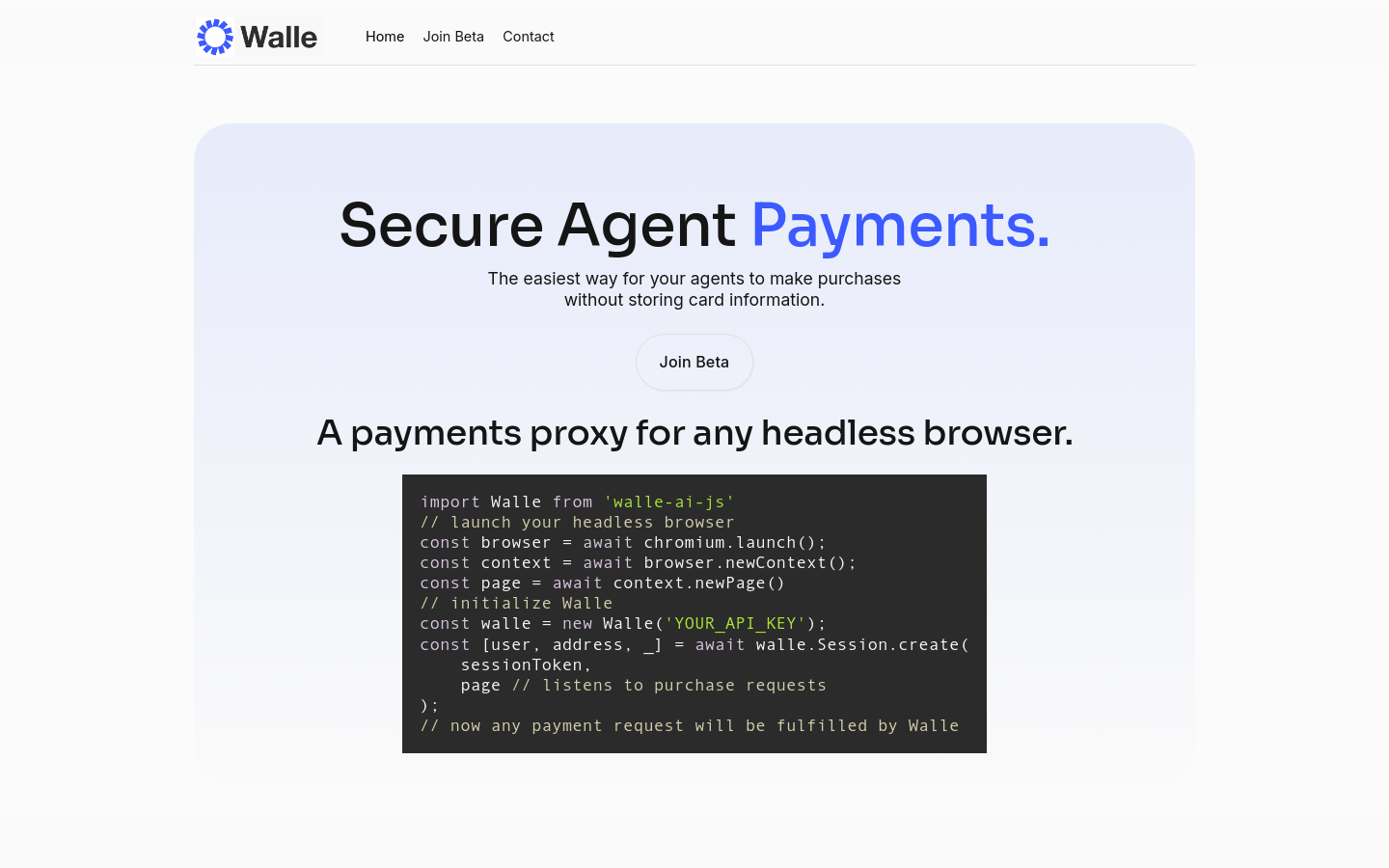

Walle is a payment broker service designed for agents that allows agents to make purchases without storing card information. This service provides agents with tools for online transactions by proxying payment requests, and supports functions such as one-time saving of card information, control of consumption amounts, OTP confirmation, blocking and monitoring activities. Walle's goal is to increase agent productivity and help businesses better manage their financial processes by providing secure and convenient payment solutions.

Demand group:

"The target audience is businesses and agents, especially those organizations that need to process a large number of payment transactions and have high requirements for payment security. The payment agency services provided by Walle can help them simplify the payment process, improve payment security, and thus better manage Finance and improving productivity."

Example of usage scenario:

Enterprises use Walle to provide secure online payment services to agents, reducing risks in the payment process.

Agents save card information once through Walle, simplifying the payment process for recurring purchases.

Enterprises use Walle's monitoring function to effectively prevent payment fraud and protect the company's financial security.

Product features:

• Make purchases without storing card information

• Supports payment proxies for any headless browser

• Provide session creation and payment request monitoring

• Supports one-time saving of card information to simplify payment process

• Provide consumption amount control and OTP confirmation to increase payment security

• Supports blocking and monitoring activity, increasing payment transparency

• Improve team satisfaction and enhance agent productivity

Usage tutorial:

1. Visit Walle’s official website and register an account.

2. Get and set your API key.

3. According to the documentation, integrate the Walle service in your headless browser.

4. Use the Session.create method provided by Walle to create a session and listen for payment requests.

5. Configure the payment process, including card information storage, consumption amount control, OTP confirmation, etc.

6. Monitor payment activities to ensure the security of the payment process.

7. Adjust payment settings as needed to optimize the payment experience.